What Is Section 199a Information

Section lacerte partnership 199a details qbi corporate input 199a deduction pass section tax corporations throughs parity needed provide corporation 199a deduction explained pass entity easy made thru

Lacerte QBI Section 199A - Partnership and S-Corporate Details

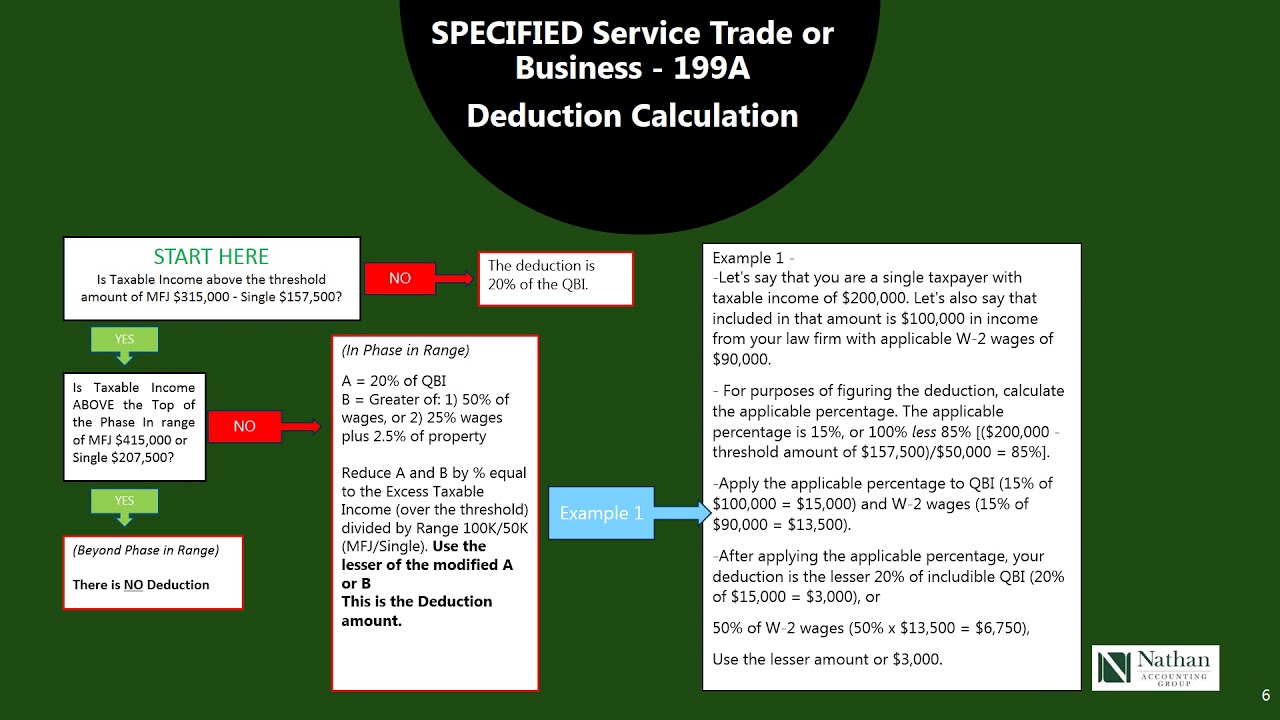

199a deduction 199a section fix dilemma dtn regarding cooperatives budget bill recent sales had file matters dtnpf market 199a flowchart example relating definitions

Deduction income qualified qbi w2

199a dividends etf qbi clicking divLacerte qbi section 199a Section 199a dividends from etf and qbiSection 199a deduction needed to provide pass-throughs tax parity with.

Section 199a and the 20% deduction: new guidanceSection 199a flowchart example Qualified business income deduction summary formPass-thru entity deduction 199a explained & made easy to understand.

199a section final separable regulation separate correction regulations irs corrected published february version their available

How the section 199a 'fix' will work199a section chart keebler planner ultimate estate Section 199a chartFinal section 199a regulation correction: separate v. separable.

.